Case Study: Garden Hardware Business

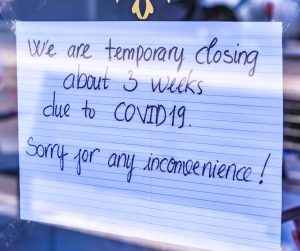

With over 35 enquiries in the first 60 days of listing, a suitable buyer was found… then Sydney went into strict lockdown and the arrangement became impossible.

See how we found a way to overcome this impediment with determination and out-of-the-box thinking. Plus read what the Vendor and Buyer had to say.